Enhance the Value of

Investment Decisions

Proven approach for complex business challenges.

Asset Investment Planning (AIP) solution is part of an extensive IPS portfolio. It provides powerful capabilities and enhanced intelligence to assist in planning and managing Asset Investments, optimizing the benefits, costs, and risks for high-value Assets.

ASSET INVESTMENT PLANNING

While IPS Asset Performance Management and Enterprise Asset Management solutions support primarily the daily or weekly operational decisions and actions to improve the reliability and availability of the assets, IPS® Asset Investment Planning software enhances complex, longer-term tactical and strategic decisions relating to the CAPEX/OPEX budget allocations and overall asset management planning. IPS®AIP systems leverage asset data (primarily sourced from APM and EAM systems) to predict the current and future performance of the asset base over a predefined time frame.

CAPEX/OPEX

Portfolio Monitoring

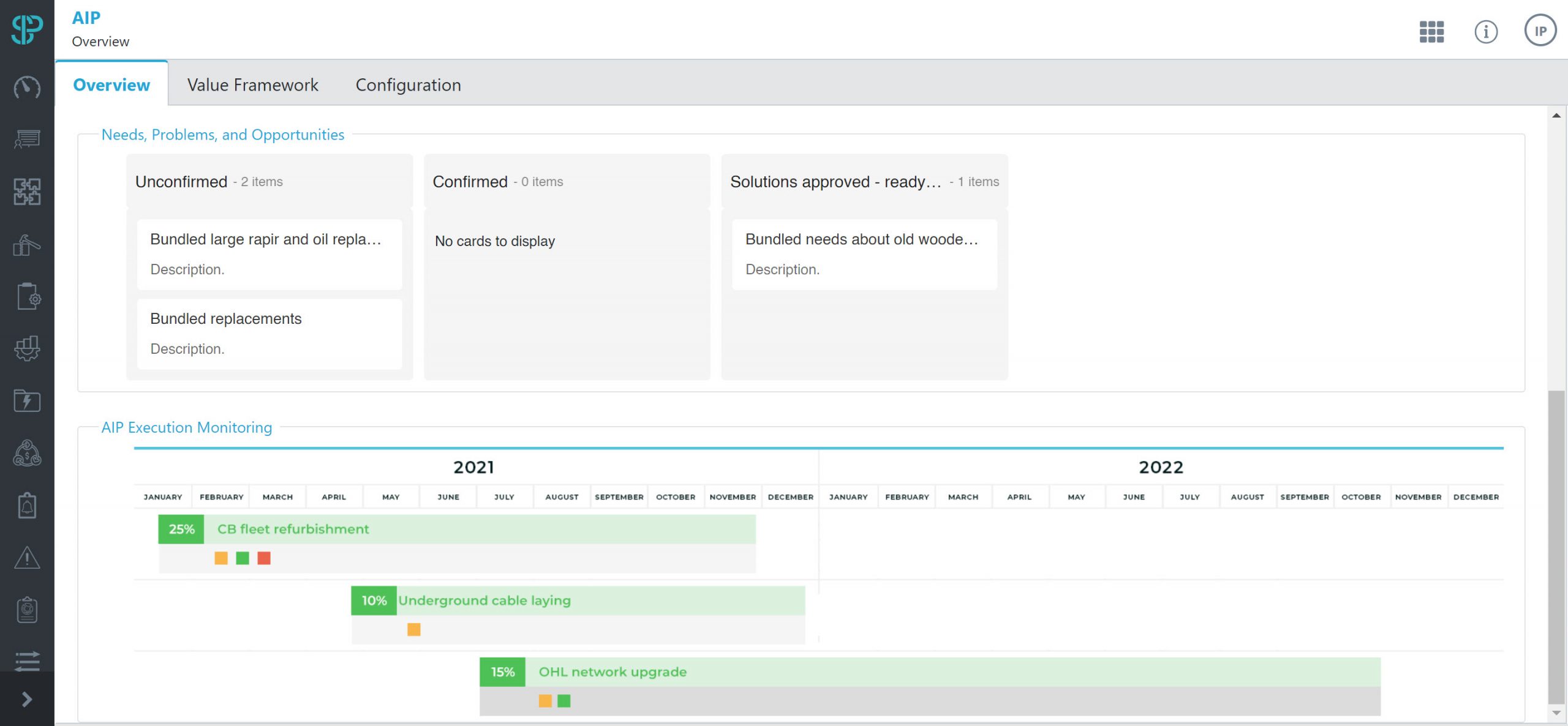

Identify needs, problems and opportunities

IPS®AIP Configuration

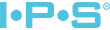

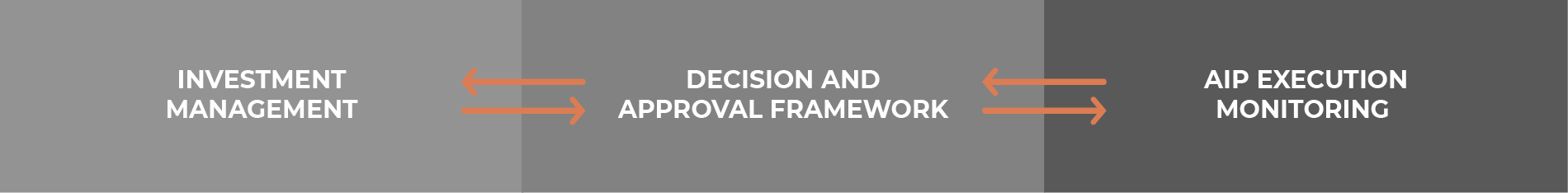

IPS®AIP configuration offers flexible customization to cover all AIP processes but also specific clients’ needs. It is centralized and auditable support of the repeatable AIP steps and functions. Three key sections are investment management, decision and approval framework, and AIP execution monitoring. UI is based on custom-form logic so users can create an infinite number of pre-designed elements, with a user-friendly and intuitive drag and drop user interface.

A typical example is to set all useful fields for a selected AIP solution like name, description, asset need date, delivery times and delays, and much more.

Why IPS® Asset Investment Planning?

Optimally balance costs and risks and improve performance.

IPS®AIP solution provides the powerful ability and intelligence to plan and manage Asset Investment, with the best optimization of the benefits, costs, and risks for high-value assets. The Asset Investment Planning Solution brings together all the powerful functionality of IPS®SYSTEMS relating to Asset Health and Risk, Asset Management, Outage Management, and Business Process Management module. It provides an integrated solution to streamline Asset Investment Planning by including all relevant information, data, and factors in the analysis of needs and options.

Optimal Asset Investment Plans are produced to suit your business needs and priorities, considering regulatory and budget constraints as well as consideration of risks, costs, and benefits associated with reliability, performance, safety, and environmental factors.

Identify, Prioritize, Bundle

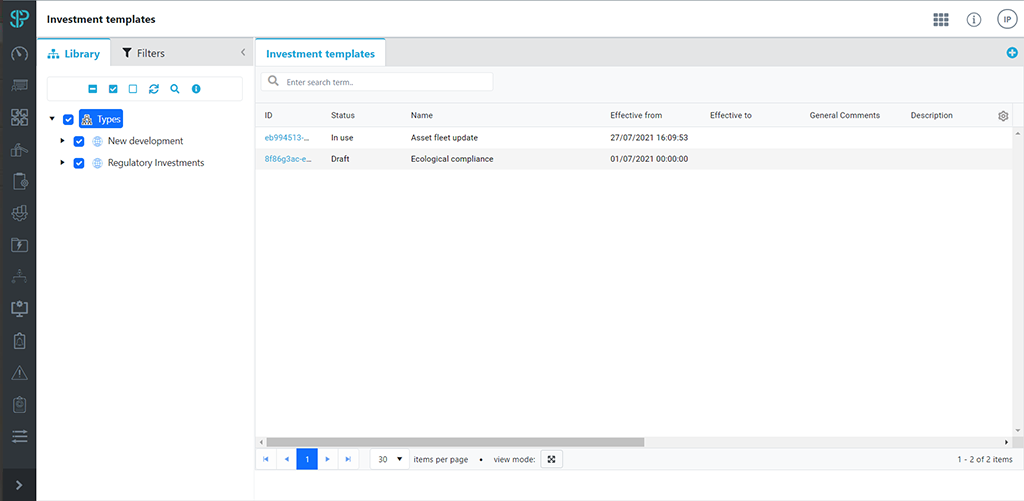

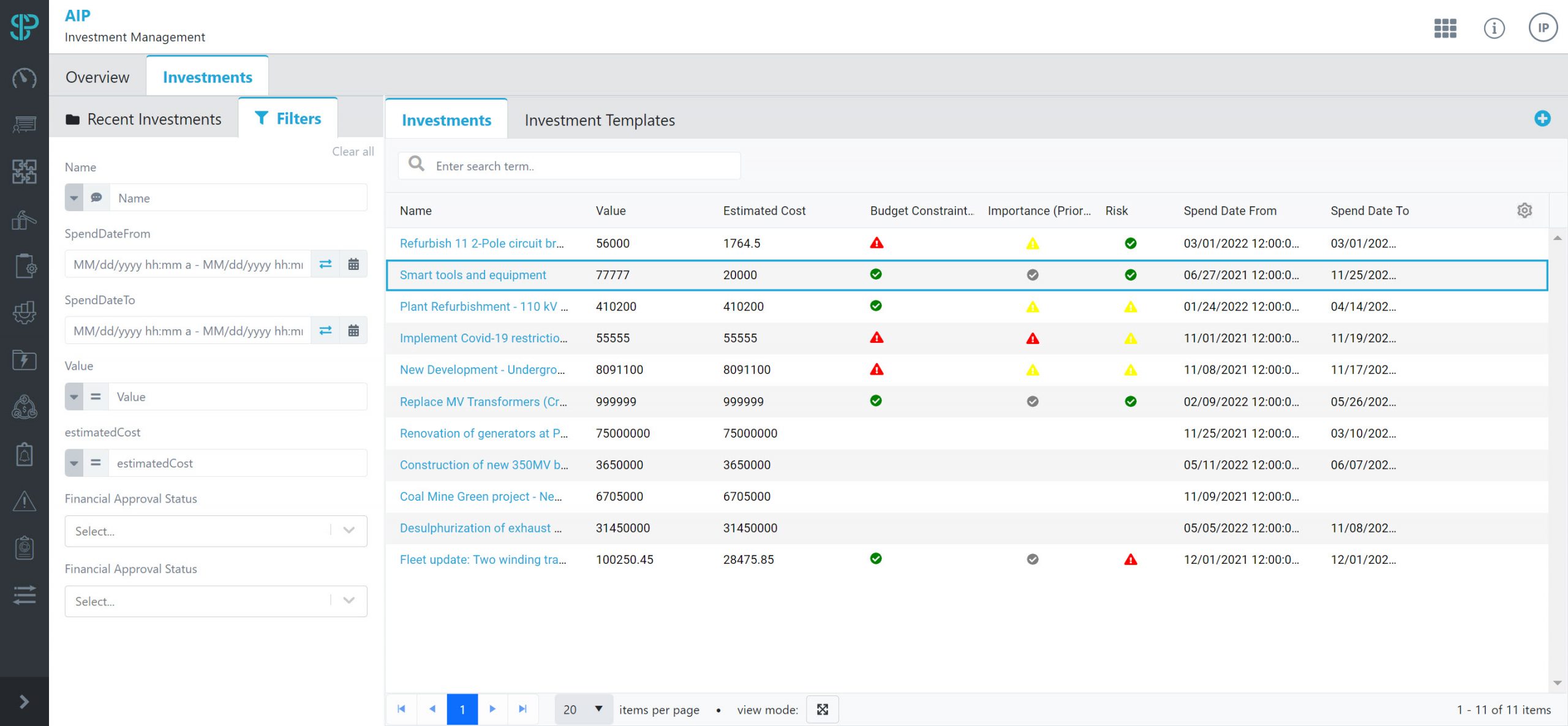

AIP – Investment Management Template Library

The investment management setup is based on a customizable investment template engine. Users can set investment-specific elements like investment stage, investment owner, investment region, and much more. This is where investment alternatives can be connected and compared. Users can customize the master investment dashboards including investment overview, forecast, risk analysis, and other investment value charts and diagrams. Also, users can customize dashboards for monitoring of AIP solutions bundled into e.g., projects, portfolios, programs. Portfolio monitoring includes scenario viewers for OPEX and CAPEX projects.

Smart Predictions Using Machine Learning

IPS®AIP makes predictions based on an asset lifecycle rules engine and a simulation engine for option evaluation. IPS AIP algorithms are based on machine learning and standard methods of asset performance calculation logic, such as the UK DNO enhanced method with D VDE-0109 (IEC TS/6 XXXX) and IPS’ international experience.

What-if Simulations

Simulation inputs and APM asset analysis indexes are combined with data-driven algorithms to get a preferred investment solution. The options assessment simulation engine is based on data science algorithms, standardized asset performance calculation logic methods, and a customizable asset lifecycle rule engine. Implemented machine learning includes additional asset data processing, asset clusterization, risk asset classification, and regression budgeting.

Define your AIP KPI’s

To reap all the advantages of the AIP solution it is essential that all plans and scenarios meet organizational objectives. Once goals are defined, strategies can be aligned and defined for how to achieve these outcomes using assets, objectives for achieving strategies, and a set of KPIs to measure growth on these objectives. IPS®AIP is aligned with the ISO 55000 standard, which specifies how to operate assets at agreed-upon service levels while optimizing the total cost of ownership at an appropriate level of risk.

IPS® MODULES FOR ASSET INVESTMENT PLANNING

IPS®SYSTEMS are distinguished by modular design. Customers can add individual module groups according to functional requirements and perform the gradual implementation of the system – starting with basics and implementing full functionality step by step.

IPS®LUNA for Asset Investment Planning

IPS® Asset Investment Planning is an advanced module that is built-in IPS®LUNA, a new web-based platform with independence and minimization of IT maintenance. With global availability, users can access from anywhere.

Start planning your investments today!

Book a 60-minutes free demo to find out how to manage long-term investments in more intelligent way and save valuable resources.